Financial services firms across the globe are offering trading applications and financial planning services through cloud technologies, smartphones, social media, and robotics to reduce costs and improve service quality.

Often, proficiency in financial services is well-thought-out to be the backbone of any economy and indicates the socio-economic well being of any country. With rapid globalization, financial services providers are facing the uphill task of providing software and applications that are risk and complaint free to the end-users. Moreover, several firms in this space have been focusing on devising robust and decisive market strategies to attract consumers.

Let’s look at some of the fundamental factors that will influence the growth prospects of the financial services industry in the coming years.

- Mobile Banking – Financial services firms have to develop new digital delivery strategies to remain competitive. For instance, incorporating mobile banking as a regular delivery channel.

- Next-generation Platforms – Many firms rely on legacy systems to conduct operations. To address these issues and target the right customers, companies operating in this space need to migrate their current technology architectures to next-generation capabilities quickly.

These factors are forcing firms operating in the financial services space to leverage the use of market segmentation solutions to profile the needs and wants of the customers and develop products accordingly. These studies also help firms overcome the factors influencing the growth, take advantage of the new prospects, and reduce costs across business units.

The Business Challenge

- The client: Financial services major

- Area of Engagement: Market Segmentation

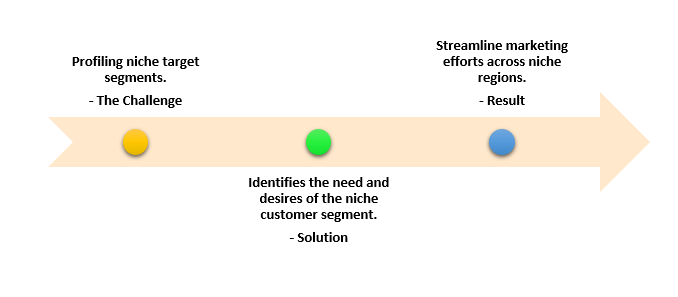

The client, a leading player in the financial services space, wanted to personalize their marketing efforts and target niche customer segment and offer enhanced customer service and satisfaction. The client also wanted to be more efficient in allocating their resources across their business units.

Want more information about our market segmentation solutions?

Want more information about our market segmentation solutions?

The Journey

To effectively segment niche customers, position their product offerings, and allocate resources accordingly, the market segmentation experts at Infiniti carried out extensive research and interviews with prominent stakeholders in the financial services industry. The experts also gathered information from various secondary sources such as paid industry databases, company presentations, and industry forums.

The Solution Offered and the Business Impact

The market segmentation solution offered by Infiniti helped the financial services industry client identify the niche customer segments and cater to their specific needs and desires to stay ahead of the competition. This engagement also helped the client accurately forecast customer preferences, accordingly position their product and service offerings, and seamlessly meeting their requirements.

The Future

The future of the financial services industry is expected to witness firms looking to pair mobile platforms with their brick-and-mortar branches, all while earning rewards of a stronger economy and improved consumer satisfaction and confidence.