Automotive market intelligence adds more horsepower to growth plans

Auto sales in the US were up 2.5%, beginning of this year, compared to January 2023, with total new vehicle sales exceeding 1,080, 000 units. Ford F-Series, Toyota RAV4, and Tesla Model Y were some of the top-selling models in January 2024. Consumers’ spending and the extent of optimism they feel about the state of the economy are key factors underpinning automotive sales and production levels. Consumer preferences represent a shaping force automotive industry participants can ill-afford to ignore. Their growing preferences for EVs and hybrids is an unmistakable trend informed by customers’ concerns about long-term shifts in the earth’s climate system.

Some of the other key buyer preferences center on autonomous driving and safety systems (e.g., adaptive cruise control systems, automatic emergency brakes), in-vehicle infotainment products, and seamless smartphone-to-infotainment-module connectivity. Buyers also expect auto industry participants to make them offers they can’t refuse, such as dependable after-sales maintenance, additional warranties on top of standard ones, and easy parts availability at affordable price points. So far, as participants in the automotive landscape (like OEMs, tier 1/2/3 suppliers, parts manufacturers, wholesalers, and distributors) are concerned, there is a vast number of data points on the market that they need to stay on the top.

Importance of the Service

Size up the market, then get in on the action

Apart from evolving consumer behavior, the auto industry needs to be up to the minute on market shifts, competitor info, and ever-changing government regulations. Therefore, it is important for participants in the automotive value chain to analyze large chunks of external data around the exchange of their goods and services to make the most of opportunities (e.g., emerging markets) and negotiate challenges (e.g., changing consumer preferences, buyers’ perceptions about competitor products). Market sizing is a key subsystem of automotive market intelligence. In an era prior to autonomous computing systems, auto businesses would “guesstimate” the potential market share for their products based on primary and secondary data. The advent of AI has brought remarkable accuracy and efficiency to not just market sizing, but also to automotive market intelligence,sales, and customer experience in the auto industry.

Sell aspirations, not Nissan Versas and Rolls-Royce Boat Tails

Automotive market intelligence helps industry participants estimate the potential number of customers for specific offerings, based on which these businesses can determine what prices they should charge in order to maximize revenue. Auto enterprises can also identify threshold prices for each product category beyond which customers start to become more sensitive about percentage upward revision in prices. This apart, real-time info on disruptive and emerging technologies shaping the auto market (e.g., EVs, driverless cars, connected cars, advanced driver assistance features and the like) will enable auto industry C-suites to factor evolving customer aspirations into their key decisions.

Confidently embrace the future

Predictive analytics and AI have put more teeth into traditional automotive market intelligence. These predictive analytics models include machine learning algorithms trained on vast amounts of historical and current sales data, customer opinions, preferences and complaints, and market research info. The training data might also include government metrics and various economic indicators (such as GDP, inflation rate, consumer confidence index, interest rates). This almost boundless ocean of data forms the basis for accurately predicting future market outcomes for auto industry participants.

How Infiniti Research can help you?

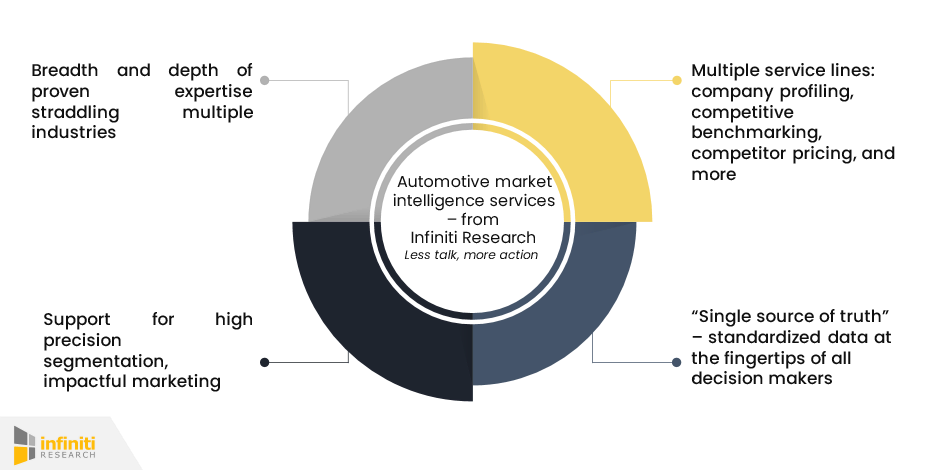

Clearly, no business, no matter its size, can thrive without de-misting its customer dashboard and getting a clearer view of what the customer wants. In order to be commercially successful, business heads need the uncanny skill to single out profitable customer groups from the unsorted mass of customer data out there. Because those are the ones who will most likely pay for the business’s services. This calls for highly evolved and bespoke market intelligence, including automotive market intelligence services. At Infiniti Research, our experts provide breadth and depth of market intelligence services for businesses across sectors. Infiniti Research is 20 years old and counting… And in the past two decades, small, medium, and large enterprises have defined their customer segments with high precision, thanks to our experts’ assistance. Further down the line, businesses have effectively targeted various audience segments with solutions that closely resonate with their rising aspirations, yielding positive results.

Actionable market intelligence leading to high-precision segmentation and impactful marketing for a car care business

Our client is a manufacturer of car care accessories. A general spike in consumer spending on high-quality car cleaning and restoring services is a key driver of the client’s market. The demand for used cars, which typically require more care and maintenance, is the other important force animating the client’s market. On the not-so-bright side, a dip in new vehicle sales is a concern for the sector and improving sales and margins are priorities for the client’s sector. In a high-strung market, a C-suite executive from our client’s organization needed accurate data about customer preferences to figure out their market positioning, identify right segment of customers for marketing and identify product gaps. This segmentation would then serve as the baseline to reconfigure products in line with changing customer aspirations. Our experts in automotive market intelligence had their work cut out!

Between February and March 2023, our team of automotive market intelligence experts worked closely with the client’s marketing group to develop accurate consumer personas. The objective was to help the client get a firmer grasp of the needs, preferences, and motivations of each market segment. We conducted thorough secondary research to understand what previous reports and articles cover about the target customers and their preferences. To add more details to the customer segmentation and understand customer perception we also conducted an online survey with the target customers. Our survey team created a structured questionnaire to understand the preferences of the target customers and identify the product gaps based on customer responses to the set of questions included in our questionnaire. After collecting all the responses and mapping them with secondary research data we could clearly identify key customer segments and patterns to understand customer perception. Finally, our team assisted the client in developing the most desirable market positioning strategy in the circumstance and this is helping the client’s products stand out in a highly competitive market. As it stands, the client is reaching out to the target segments with a high probability of product take-up, and fortifying this target marketing effort is our market segmentation exercise, previously discussed. The engagement is getting the intended results for the client in terms of improved sales targets and meaningful product innovations.

Conclusion

In a high-strung market, the client’s C-suite needed accurate data about customer preferences to figure out product gaps as a first step. This segmentation would then serve as the baseline to reconfigure products in line with changing customer aspirations. Our experts in automotive market intelligence had their work cut out! Our team assisted the client in developing the most desirable market positioning strategy in the circumstance, and this is helping the client’s products stand out in a hypercompetitive market. As it stands, the client is reaching out to the target segments with a high probability of product take-up. The engagement is getting the intended results for the client in terms of improved sales targets and meaningful product innovations. Fortifying this target marketing effort is our market segmentation exercise, key details of which are shared in this inspirational customer success story.