Climate-related financial disclosures have become increasingly important as the world grapples with the financial implications of climate change. These disclosures aim to provide stakeholders with a clear understanding of how climate-related risks and opportunities affect a company’s financial stability and performance. In this overview, we will explore the key frameworks and developments in climate-related financial disclosures.

The Need for Climate-Related Financial Disclosures

The recognition of climate change as a significant financial risk was highlighted by the 2015 Paris Climate Agreement. The G20 Finance Ministers and Central Bank Governors asked the Financial Stability Board (FSB) to address how the financial sector could incorporate climate-related issues into its operations. This led to the establishment of the Task Force on Climate-related Financial Disclosures (TCFD) in 2015.

Key Regulatory Frameworks

Task Force on Climate-Related Financial Disclosures (TCFD)

The TCFD was created to develop recommendations for companies to disclose climate-related financial information. Its framework focuses on four core areas:

Governance: Disclosing the governance processes for overseeing climate-related issues.

Strategy: Integrating climate risks into business strategies and identifying opportunities.

Risk Management: Assessing and mitigating climate-related financial risks.

Metrics and Targets: Disclosing specific metrics and targets related to climate performance.

The TCFD’s work has been influential globally, with over 4,000 organizations supporting its recommendations across 101 jurisdictions. Its legacy continues through the International Sustainability Standards Board (ISSB) standards, which fully incorporate TCFD principles.

International Sustainability Standards Board (ISSB)

The ISSB has developed two key standards:

- IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information.

- IFRS S2: Climate-related Disclosures, which builds on TCFD recommendations to provide a comprehensive framework for climate reporting.

These standards are effective for annual reporting periods starting on or after January 1, 2024, and their adoption is jurisdiction-specific.

Jurisdiction-Specific Frameworks

- United States: The SEC has introduced rules requiring certain companies to disclose material climate-related risks and greenhouse gas emissions.

- United Kingdom: The UK has endorsed ISSB standards and introduced Sustainability Disclosure Requirements (SDR) to enhance transparency in sustainability reporting.

- European Union: The Corporate Sustainability Reporting Directive (CSRD) mandates detailed sustainability disclosures, focusing on both financial materiality and double materiality.

Challenges and Future Directions

Implementing climate-related financial disclosures poses several challenges, and addressing these is crucial for enhancing the effectiveness of these frameworks. Here are some of the key challenges and future directions:

Challenges

-

Data Quality and AssuranceThe absence of standardized methodologies for measuring and reporting climate-related risks complicates the process of ensuring data quality and comparability.

-

Materiality AssessmentCompanies often struggle with determining what climate-related information is material and should be disclosed. This involves assessing the financial impact of climate risks and opportunities on the company's operations.

-

Resource ConstraintsImplementing climate-related disclosure frameworks can be resource-intensive, requiring significant investment in data collection, analysis, and reporting infrastructure. This poses a challenge for smaller entities with limited resources.

-

Insufficient Information from Investee CompaniesAsset managers and asset owners face challenges due to insufficient information from investee companies, which hampers their ability to make informed investment decisions.

Future Directions

Enhancing Interoperability and Consistency

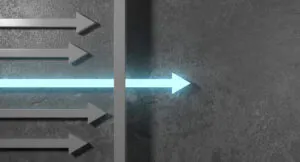

ISSB Standards Integration: Ensuring that ISSB standards are interoperable with jurisdictional frameworks is crucial for consistent reporting across different regions. This will help avoid the need for companies to report through multiple venues, reducing compliance costs and enhancing comparability.

Implementation Guidance and Sector-Specific Analysis

Developing detailed implementation guidance on topics such as climate-related physical risk assessment, adaptation planning, and sector-level scenario analysis will be essential. This will help companies better assess and disclose their resilience under different climate scenarios.

Expanding Disclosure Scope

Beyond Climate: Future efforts should focus on integrating other sustainability issues, such as biodiversity and social impacts, into financial disclosures. This will provide a more comprehensive view of companies’ sustainability performance and risks.

Assurance and Reliability

Jurisdictions are moving towards establishing assurance requirements to enhance the reliability and decision-usefulness of climate-related disclosures. This trend is expected to continue, with more emphasis on independent verification of reported data.

Global Adoption and Harmonization

As more jurisdictions adopt ISSB standards or similar frameworks, there will be a need for ongoing efforts to harmonize these standards globally. This will facilitate cross-border investment and reduce regulatory complexity for multinational companies.

Risks to Institutional Investors and Insurance Companies

Impact on Institutional Investors

Asset Exposure

Extreme weather events can disrupt business operations, leading to losses in equity, bonds, and loans held by institutional investors. For instance, floods or wildfires can damage infrastructure and disrupt supply chains, impacting the financial performance of companies in which they invest. As governments implement policies to reduce carbon emissions, companies with business models heavily reliant on fossil fuels may face reduced earnings and increased costs. This can lead to stranded assets, where investments become obsolete or less valuable due to regulatory changes.

Investment Strategies

Institutional investors are adapting their strategies to manage climate risks. Many are shifting towards climate-sensitive assets, such as renewable energy and sustainable infrastructure, to mitigate risks while maintaining returns. Engagement and risk management are preferred over divestment for many investors, as they seek to influence companies to adopt more sustainable practices.

Impact on Insurance Companies

Asset Exposures

Similar to institutional investors, insurance companies face asset-side risks from climate-related events affecting the value of their investments in equities, bonds, and other assets2.

Liability Exposures

Insurance companies are exposed to increased claims from policyholders due to climate-related disasters like hurricanes, floods, and wildfires. This can strain their financial resources and impact their ability to pay claims. Insurers may also face regulatory scrutiny and potential litigation related to their handling of climate-related risks, further increasing liability exposures.

Managing Climate Risks

Both institutional investors and insurance companies are taking proactive steps to manage climate risks:

- Scenario Analysis: Conducting scenario analyses to assess potential future climate scenarios and their impacts on investments and liabilities.

- Diversification and Adaptation: Investing in climate-resilient assets and diversifying portfolios to reduce exposure to climate-related risks.

- Engagement and Disclosure: Encouraging companies to improve climate risk disclosure and engaging with policymakers to advocate for clear climate policies.

Conclusion

Climate-related financial disclosures have become crucial for ensuring transparency and resilience in the financial sector. The TCFD and ISSB frameworks have set the stage for standardized reporting, while jurisdiction-specific regulations further enhance disclosure requirements. Despite challenges like data quality and materiality assessment, ongoing efforts aim to improve consistency and reliability. As institutional investors and insurance companies adapt to climate risks, proactive strategies such as scenario analysis and diversification are key. The future of climate reporting will involve broader sustainability issues and global harmonization, supporting a more sustainable financial system. This trend underscores a commitment to climate accountability.