Opportunities for organic fertilizers are only growing

Organic fertilizers are derived from animal or plant matter and are typically applied to the soil or directly to plant tissues to provide them with much-needed nourishment. These fertilizers can be broken down into simpler constituents through the action of bacteria or other living organisms, and this ensures they don’t persist in the environment for long. Chemical fertilizers, by contrast, remain unchanged in the environment for a long time, in the process, dirtying the ecosystem and making it dangerous to live in. Typically, organic fertilizers biodegrade into carbon dioxide, water, as well as inorganic nutrients (e.g., nitrogen, phosphorus, potassium, iron, zinc, boron) that are readily absorbed by plants. So, what exactly are driving opportunities for organic fertilizers?

A lot of times, chemical fertilizers tend to overwhelm the soil and plants with their high nutrient concentrations. By all appearances, plants experience a surge in growth as a result of chemical fertilization. But the truth hiding in plain sight is that this approach also leads to nutrient imbalance in plants. This weakens plant systems, increasing their susceptibility to various contagions, apart from reducing crop yield. Nutrient imbalance is also known to adversely affect the soil structure. On the other hand, organic fertilizers impart essential nutrients to plants and soil in a steady and consistent stream, keeping the risk of overfertilization and excess nutrient runoffs into the ambient environment to a minimum. Business opportunities for organic fertilizers are aplenty. The growing popularity of organic fertilizers may be attributed to their beneficent effects on soil health, plant growth, and the larger ecosystem.

Market size

The current market size of organic fertilizers is around $12 billion, and this is expected to jump more than 2x by the end of the decade. Of course, this might seem like just a drop in the overall fertilizer market, which is worth nearly $200 billion at the moment. But the organic fertilizers market is growing 1.6x-1.9x faster than their chemical counterparts. That’s certainly music to the ears of participants in this sector. There are huge commercial opportunities for organic fertilizers out there. It’s just that market entrants must look for the right ones. Region-wise, Asia-Pacific leads the demand for fertilizers derived from organic sources. Led by India, this region holds about 36% of the global market. Europe is another key regional market. Organic fertilizer production is seeing significant traction in countries like China, India, Germany, Poland, France, Spain, and Norway.

Demand drivers

Some of the most sought-after fertilizers derived from organic sources include compost, worm castings, poultry and livestock manure, cottonseed meal, seaweed, as well as ground animal bones. A key factor driving the take-up of organic fertilizers is the increasing consumer concern around the environmental impact of conventional fertilizers and farming methods. More than ever before, consumers are warming up to organic foods. The perception that organic foods are healthier and safer since they are free of chemical residues (such as “remnants” of veterinary drugs, feedstuffs, artificial chemicals, and various additives) is working in their favor. Government subsidies for practitioners of sustainable farming and bio-fertilizer usage are also helping elevate opportunities for organic fertilizers in a big way. Market development assistance, in the form of finance support and buyer-seller meet-ups and exhibition participations, is also providing a shot in the arm, especially for small and mid-size producers and suppliers of organic fertilizers.

Growth inhibitors

Every opportunity is accompanied by one challenge or other. The case is no different when it comes to opportunities for organic fertilizers. Higher production costs for organic materials, compared to chemical alternatives, translate to higher prices in the hands of users, and this can be a deterrent to their adoption. There are issues to be resolved like the lower nutrient concentrations of organic fertilizers and the slower rate at which they release nutrients. Speedy resolution of these concerns will help accelerate organic fertilizer adoption. Besides, both producers and users must step up vigil to curb fake organic fertilizers doing the rounds in the market.

How Infiniti Research can help you?

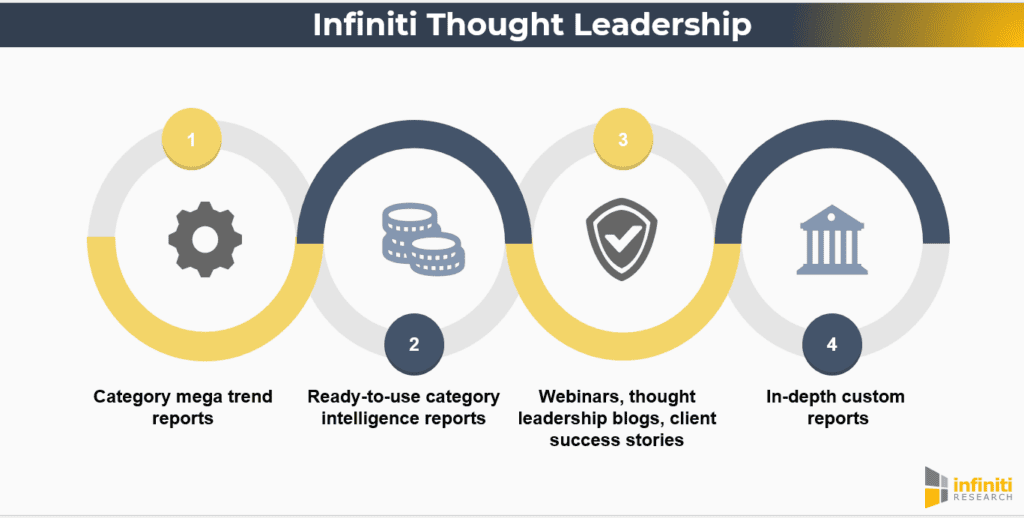

At Infiniti, our experts conduct in-depth research on behalf of our esteemed clients to enable them to identify and evaluate suppliers as well as discover opportunities for organic fertilizers and other organics. Leveraging more than 20 years of core industry-specific expertise, we meticulously identify reputed and dependable organic suppliers and assess their capabilities. Thus, our experts ensure clients are able to hold their suppliers to the high standards of the organic sectors. By arming client enterprises with actionable research insights, we help their C-suites make more informed decisions, mitigate risks, and, more importantly, optimize their procurement processes. We help clients bring into being a thriving, sustainable, and reliable supplier ecosystem for their organic products and ingredients. This helps them discover and engage growing markets, such as the opportunities for organic fertilizers, for instance.

Infiniti Research also provides clients with the visibility they look for in their supply-side operations, thus enabling them to proactively identify potential disruptions and risks in their supply networks. These threats range from squeezed supply lines to quality issues and more. Our capabilities at Infiniti Research also extend to price trends monitoring and forecasting.

An F&B business finds a dependable and ESG-friendly supplier for crucial organic inputs

Our client is a well-known food and beverage (F&B) business in North America. Key products include a range of popular fruit juices (e.g., apple, mango) and bread types (such as sourdough and sprouted).

Fruit juices tend to have high levels of suspended solids and microscopic solid particles, so these are subject to a clarification process that outputs a clear and transparent product. Enzymes and microbial cultures are key to the clarification of juices. Improving bread quality (flavor, aroma, texture, crumb structure, dough strength, and ability to stretch and expand) is another application of enzymes and microbial cultures. Microbial cultures also reduce hydrogen peroxide formation, and this is crucial to extending the shelf life of various F&B products. For a variety of reasons like cost competitiveness, the need for supplier diversification, ready availability, and expertise, our client sources some of these key molecules and microbial organisms from suppliers in Asia and Europe. The supply chain for these input materials happens to be an extended one, and the client is worried about issues associated with a lengthy multi-stage, multi-stakeholder supply chain. These include quality issues, erratic supplies, higher costs, and lower profitability. The F&B business turned to our experts for assistance.

Backed by more than two decades of first-hand experience, our specialists got down to work. From a larger field of suppliers, our experts produced a filtered list of potential vendors with proven F&B experience. Quality certifications (ISO, GMP, FSSC 22000) and key KPIs around delivery accuracy and quality (e.g., customer satisfaction scores, first attempt delivery rates, one-time in full shipments) were some of the other criteria for shortlisting suppliers. Parameters like production throughputs, suppliers’ fiscal stability, and overall bankability were also considered. Independent third-party audits of suppliers’ ESG compliance and performance were also important yardsticks in our supplier vetting. The client is in the advanced stages of negotiation with a few suppliers from our shortlist. Our experts are assisting the client in the negotiation process as well and a mutually beneficial deal is in the making.

Author’s Details

Vinodh Kumar Kshatriya

Vice President