Author: Bharat

Where does IP Camera SoC stand?

IP Cameras (IPC) have evolved over the past two decades; from being able to have a basic connectivity to establish the recordings in a network drive to the current capability of capturing enhanced images, inclusion of smart analytics, improved wireless connectivity, cloud storage, and edge computing. Increasing feature addition and visual capturing capability requirements have driven the IP camera manufacturers to include technologically advanced and low-power factor system on chip (SoC) solutions in their product portfolio.

The need to capture high-resolution images with higher refresh rates and incorporation of smart analytics including motion capture, facial detection, and automated surveillance is driving the SoC suppliers to develop integrated products that not only address the requirements, but also focus on the data security, processing time, energy efficiency, and AI integration.

The current challenge faced by the IPC SoC suppliers in integrating the flexibility of software and performance of the hardware is set to be overcome by inclusion of application specific instruction set processors (ASIP). The implementation of ASIP enables the chips to deliver application specific instructions effectively, improve the overall system performance, and have a check on optimal energy management.

The organic growth in the IP cameras market was mainly driven by the need for implementing latest features in surveillance and data analytics. This has directed the semiconductor suppliers to innovate on multi-directional aspects of chip design and the overall manufacturing process. Leading IPC SoC companies are driving their manufacturing towards the implementation of 5 nm process technology to address better power management and reduce the size of the hardware.

Need of the hour – feature enhancements

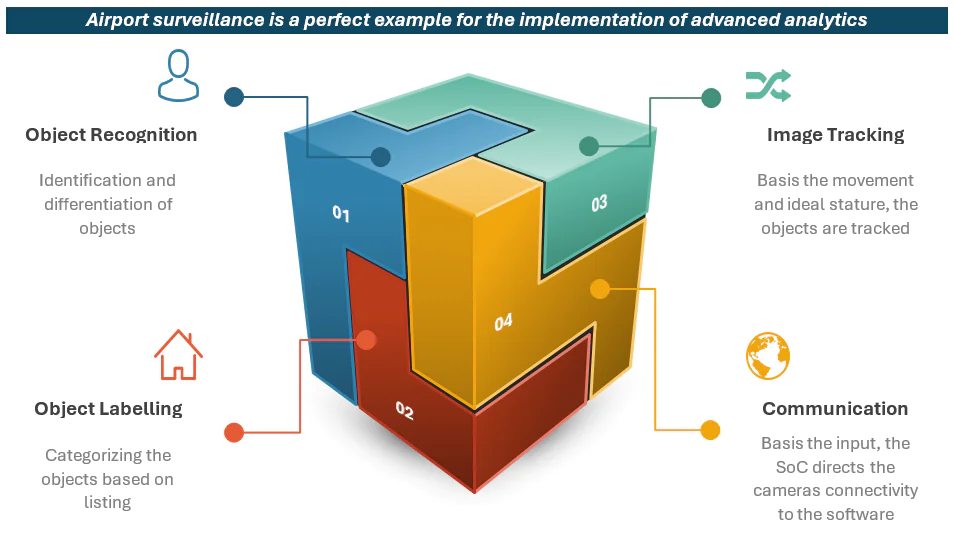

Globally, the major contributors to the widespread application of IP cameras lies in the areas of image quality, ease of connectivity, and advanced tools to analyze the images. IPC manufacturers in collaboration with SoC suppliers constantly engage in addressing the increasing demand of the end-consumers. IP Cameras have extended to 8K resolution for some of the critical surveillance applications like airport security, vehicle license plate recognition, and city-wide surveillance; this has been possible with the improvements in the image processing unit.

The integration of image signal processors with a 1 GHz or 1.6 GHz CPU/ GPU has a strong impact on the image quality and the refresh rate for video storage. These improvements in the general processing capabilities of the SoCs have given a new dimension to the surveillance market.

IPC SoC suppliers have gained popularity in the implementation of neural network image processing which provides detailed observation and enhances object differentiation. Currently, convolutional neural network (CNN) is dominating the IP SoC market with its ability to provide object differentiation with minimal datasets. Transformer type image processing provides a wider aspect by the inclusion of voice and natural language processing methods; but this variant requires a large range of datasets for image classification.

The next level of innovation in the image processing network is expected in the area of integration of neural network image processing with transformers which is expected to provide advanced object differentiation and can be implemented through edge computing or cloud stored datasets.

Degree of freedom and the single screen coverage span are some of the key factors in determining the type of camera required for an application. Globally, IP cameras used in public surveillance installations is dominated by Pan-Tilt-Zoom (PTZ) cameras with the degree of freedom extending from 0°-360°. With features like motion detection and motion tracking gaining traction in surveillance industry, IPC SoC suppliers are including advanced motor control modules as a mandatory feature in the chipsets.

Data Data Data!!!

Advanced analytics is becoming the need of the hour for many applications, chipset suppliers are engaging in integrating AI enabled chipsets to address the current scenario of standalone IP cameras driven through platform support. The integration of AI enabled IPC SoC will enhance the operability of the cameras thereby increasing the performance of data analytics. Improvement in the performance of data analytics is supported by the inclusion of AI accelerator and AI processor in the IPC SoC solutions. Companies like NXP and Mediatek provide these solutions enabling the improvement in faster image recognition and labelling. These solutions enhance image processing quality and address storage optimization.

Surveillance and industrial companies experience a large amount of junk data getting stored in the cloud. To overcome this scenario, IPC SoC suppliers are enabling edge computing capabilities on the IP cameras. This enables the end-users to transfer and store only relevant data and reduce the amount of continuous data transferred.

Hardware footprint

The IPC SoC industry is witnessing an increase in need of implementing multiple features, reduction in the size and cost of the hardware, and energy efficiency. Smaller IPC hardware footprint has been encouraged by the end-user segments for ease of implementation and smaller coverage in the overall surveillance design. IP SoC suppliers are in the process of moving from 14 nm process technology to 5 nm process technology during the designing phase. Inclusion of Configurable Analog and Digital Mixed-Signal (CASM) technology in the designing of SoC, the suppliers are able to achieve better performance, improved energy efficiency, and reduction in the size of the chipset.

Is the data secure?

The vulnerability of the images getting accessed through hacking and open authentication in an open or closed surveillance networks is a key concern for the end-users. Hacking into the overall surveillance system will open the door for the online attackers to gain access to critical information and the end-user might lose control of the systems. To overcome this scenario, security solutions are implemented at the independent field devices level. IPC SoC suppliers play a major role in the implementation of critical cyber-security features thereby enhancing the overall security of the devices.

Professional IPC solutions in the areas of industrial process monitoring, machine vision, and robotics need to have a high level of security. The high possibility of data manipulation through these cameras drives the IPC SoC suppliers to strengthen the security level at each of the drivers used in the chipset.

The way forward

IPC SoC suppliers play a very important role in the surveillance and industrial applications value chain. The companies work in tandem with the current developmental needs of the end-user segments and provide a robust and feature-rich solution. Driven by the different applications and features in the IP cameras, the SoC suppliers are expanding their product portfolio and extending it towards application-specific solutioning. With an increase in the amount of visual analysis needed in the end-user segments, the IPC SoC market is expected to grow at a rate close to double digit in the next five years.